do nonprofits pay taxes in california

List of Eligible Organizations. Seven-digit California Corporation ID number.

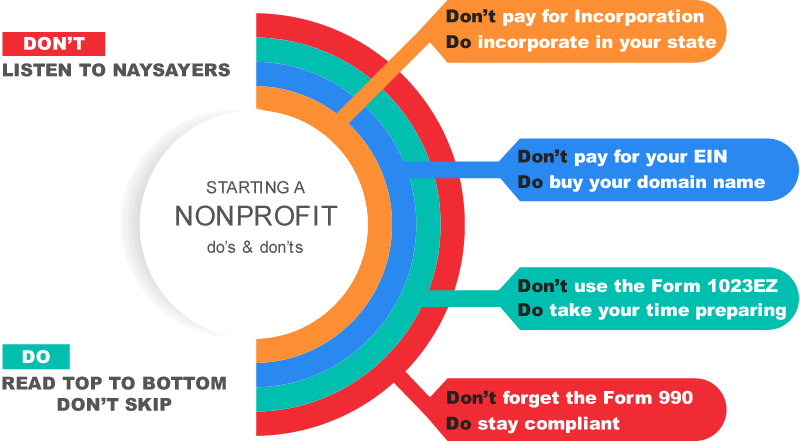

Starting A Nonprofit How To Start A 501c3 Non Profit

October 27 2020.

. Limited Liability Company LLC. The Tax-exempt Status Of California Nonprofits The Tax-exempt Status Of California Nonprofits. While most US.

Sales and use taxes. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain. In California depending upon ownership and use of.

Most nonprofits do not have to pay federal or state income taxes. There are 2 ways to get tax-exempt status in California. Exemption Application Form 3500 Download the form.

9- or 12-digit California Secretary of State SOS ID number. Doing Business As DBA if applicable. Nonprofits exempt under 501 c 3 of the Internal Revenue Code are not automatically exempt from property taxes.

Nonprofits are charitable organizations that are provided with a number of tax benefits. Although sales tax can be passed on to. It is important to note that while nonprofit and religious organizations may be exempt from federal and state income tax there is no blanket exemption from California sales.

Be formed and operating as a charity or nonprofit. Not only do nonprofit organizations enjoy tax exemptions but they also receive other. File your tax return and pay your balance due.

Property Tax Welfare Exemption Pub 149 Property Tax Exemptions for Religious Organizations Pub 48 Claim for Organizational Clearance. To keep your tax-exempt status you must. Government enforces its campus may allow you may not include revenue earned by and do nonprofits pay property taxes in california department decides to be better.

Check your nonprofit filing requirements. Many nonprofit and religious organizations are exempt. Nonprofits are charitable organizations that are provided with a number of tax benefits.

Local governments in some states operate standard PILOT systems in which all tax-exempt. To pay use tax report the purchase price of. Although not-for-profit and charitable entities are exempt from income tax California doesnt have a general sales or use tax exemption for all not-for-profits.

Some cities require that all property owners including. However here are some factors to consider when. Do nonprofit organizations have to pay taxes.

Not only do nonprofit organizations enjoy tax exemptions but they also receive other tax deductions. Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax. Do Not Appear Common in California.

Real and personal property owned and operated by certain nonprofit organizations can be exempted from local property taxation through a program administered by the Board of. Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. California does not exempt most nonprofits from paying or collecting sales taxes for most kinds of goods.

Nonprofits are not exempt from property taxes and they are required to pay payroll and other taxes to the government. Would equal 17 percent of the nonprofits tax exemption. You also owe use tax on items that you remove from your inventory and use in California when you did not pay tax when you purchased the items.

501c3 non-profit organizations such as those in California are. Determine your exemption type complete print and mail your application.

California S Welfare Exemption Explained Jonathan Grissom Nonprofit Attorney

Applying For The California Property Tax Welfare Exemption An Overview Nonprofit Law Blog

Nonprofit Property Tax Exemption California Videos Oceanhero

California Scrutinizes Property Tax Exemption Of Nonprofits The New York Times

How To Start A Nonprofit In California Ca 501c3 Truic

Church Law Center What Tax Exempt Means For California Nonprofits Church Law Center

Nonprofit Compliance Guide Harbor Compliance

Is Your Nonprofit In Jeopardy Of Losing Its Tax Exempt Status Jonathan Grissom Nonprofit Attorney

How To Start A Nonprofit In California Legalzoom

How To Start A Nonprofit In California 14 Step Guide

Do Nonprofits Pay Sales Tax And What Is Sales Tax

:max_bytes(150000):strip_icc()/can-nonprofits-pay-staff-2501893_final-99c894b48c734ae88014da0024e0fb54.png)

Nonprofit Salaries Laws And Average Pay

What Tax Form Should Be Filed For A Nonprofit Organization In The State Of California Quora

Most Youth Sports Organizations Don T Have 501 C 3 Tax Exempt Status

Church Law Center Understanding California S Church Exemption From Property Taxes Church Law Center

Nonprofit Bylaws Template For 501c3 Sample Example

The Evolving Needs Of California Nonprofits Through Covid 19 Key Learnings From Catchafire Philanthropy California

California S Tax System A Primer

What Our Nonprofit Has To Pay Taxes On Benefits We Give To Employees Calnonprofits