how much taxes does illinois take out of paycheck

Personal income tax in Illinois is a flat 495 for 20221. Although you might be tempted to take.

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

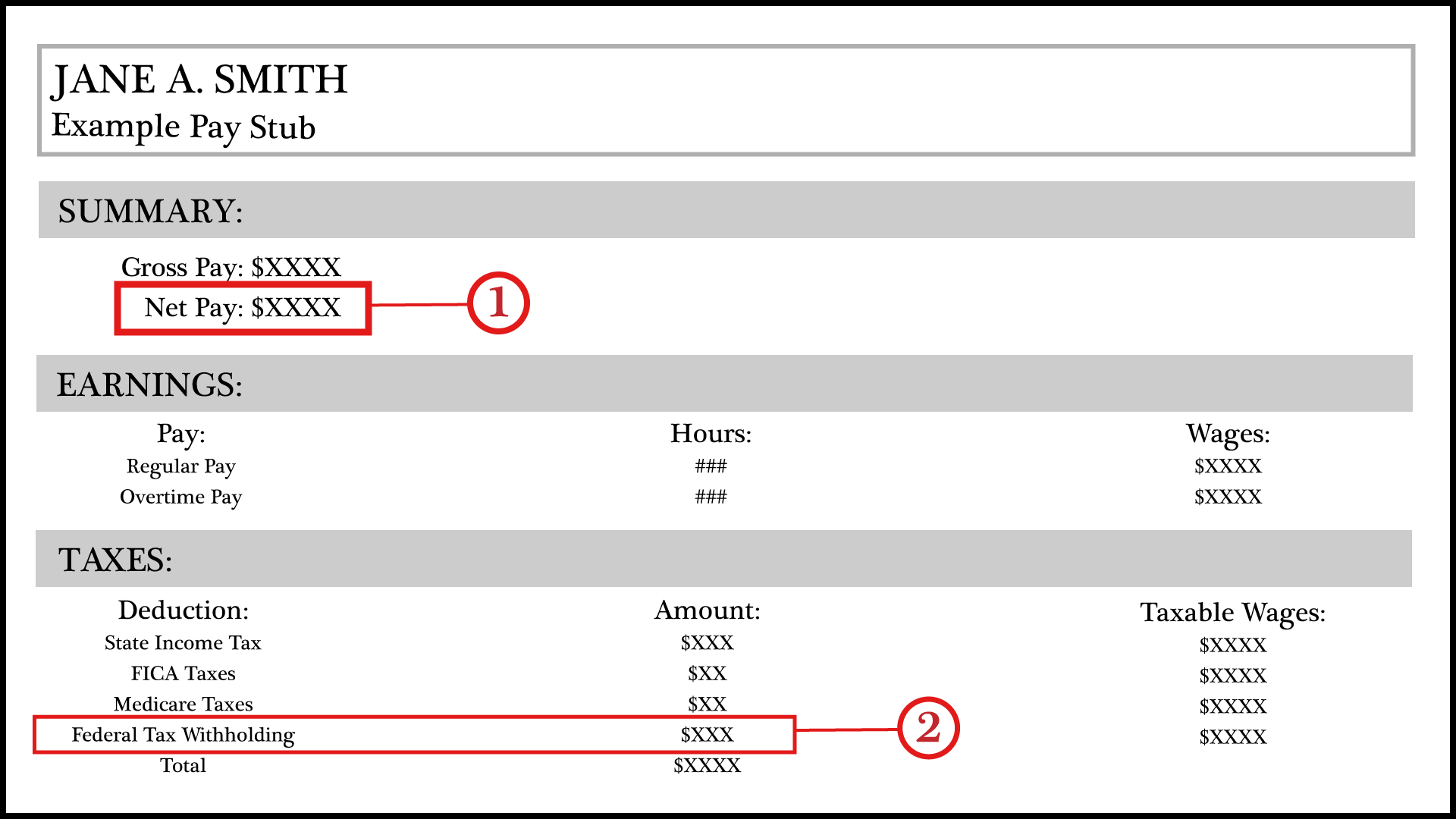

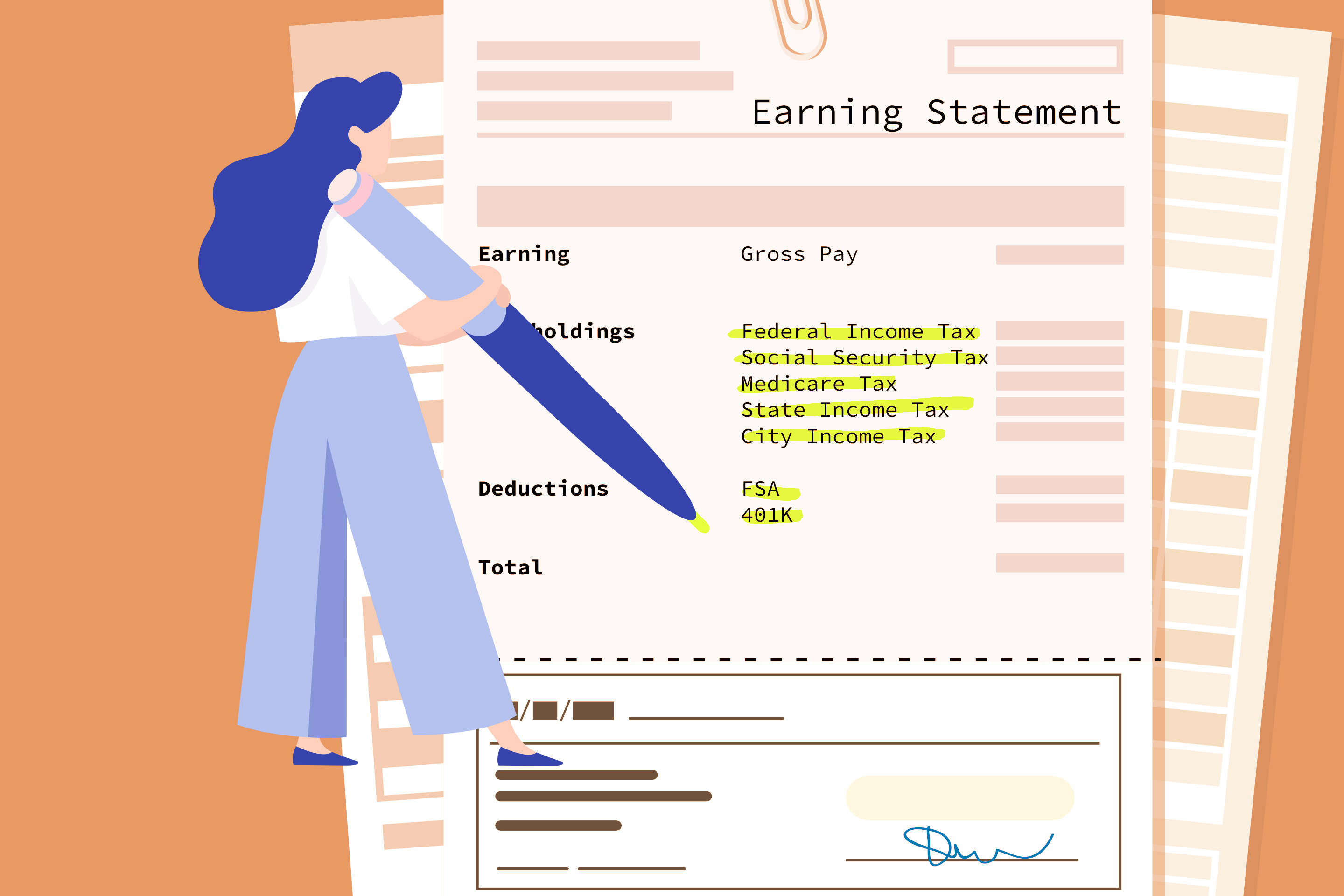

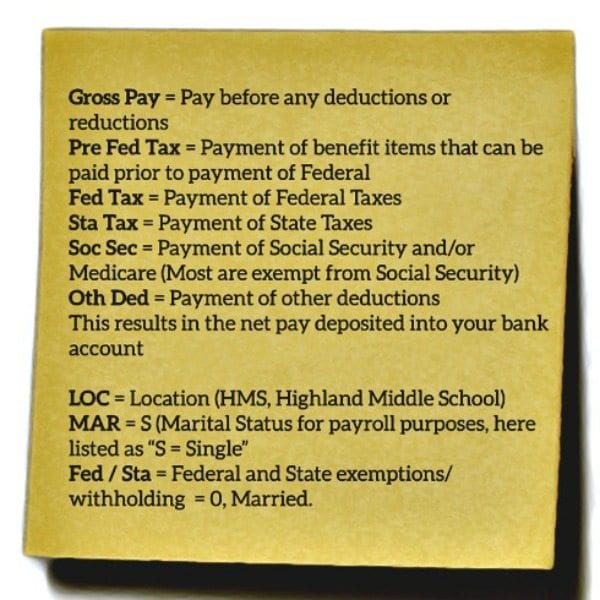

Your employer will withhold money from your paycheck which means you cant.

. Interactive Tax Map Unlimited Use. Median household income in Illinois. Illinois has recent rate changes Sun Jul 01 2018.

The Illinois income tax rate is 495. These are contributions that you make before any taxes are withheld from your paycheck. Yes Illinois residents pay state income tax.

Illinois is one of 13 states with an estate tax. Employers in Illinois must deduct 145 percent from each employees paycheck. Regardless of your filing status the income tax is.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Flat tax makes for simplified a tax filing. That means the money comes out of your paycheck before income.

Select the Illinois city from. Although you might be. The Powerball jackpot is a record 204 billion.

Ad Lookup Sales Tax Rates For Free. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Ad Lookup Sales Tax Rates For Free.

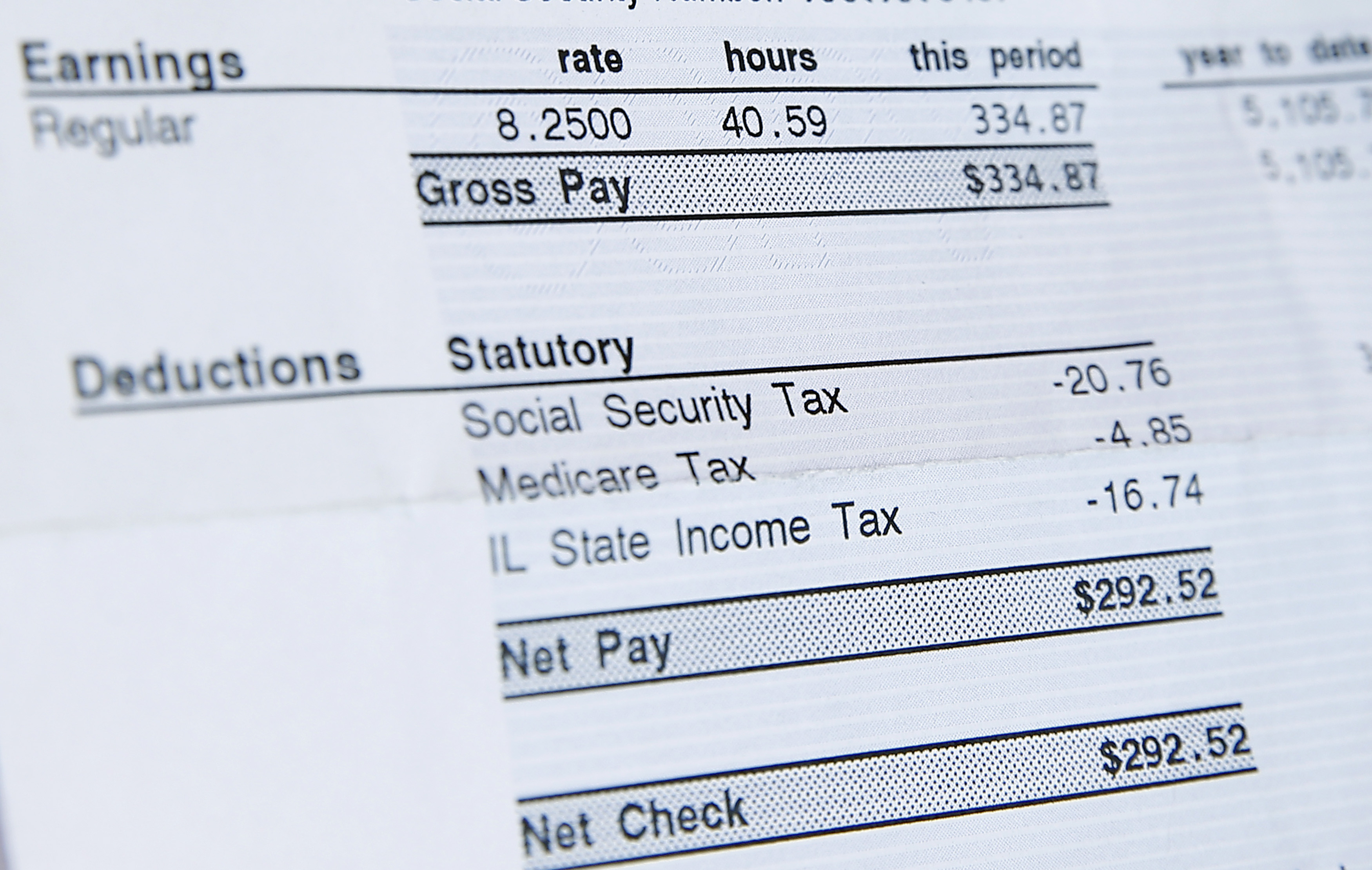

Winners will be hit with a. Personal income tax in Illinois is a flat 495 for 2022. Amount taken out of an average biweekly paycheck.

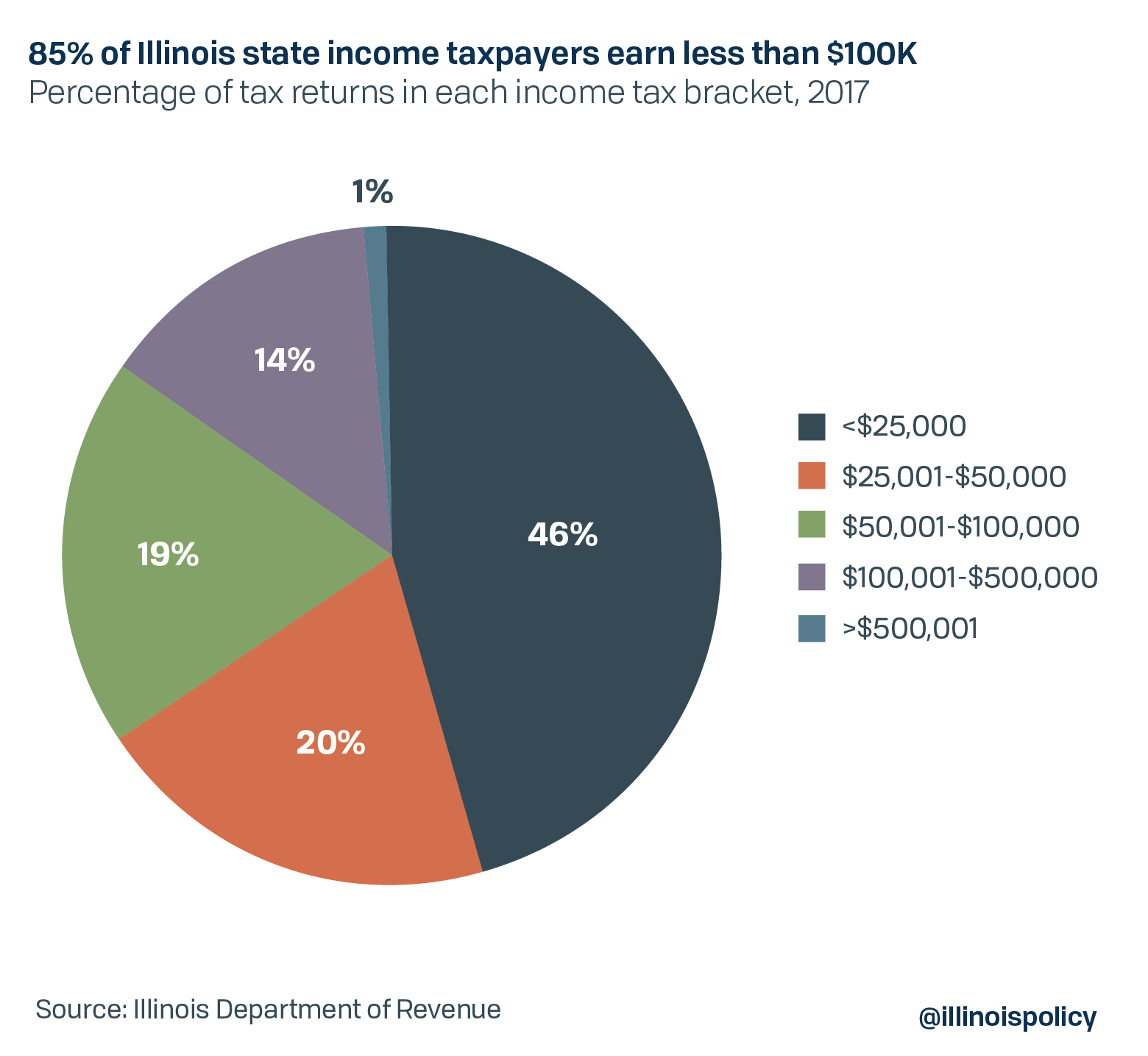

To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and. Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or. According to the Illinois Department of Revenue all incomes are created equal.

Illinois income tax rate. The Illinois state income tax is a flat rate for all. Interactive Tax Map Unlimited Use.

Learn What EY Can Do For You. Illinois Paycheck Quick Facts. As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625.

100s of Top Rated Local Professionals Waiting to Help You Today. The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax. Yes if you are a resident of Illinois you are subject to personal income tax.

Ad Scalable Tax Services and Solutions from EY. What taxes do Illinoisan pay. Assuming a top tax rate of 37 heres a look at how much youd take home after.

Illinois Estate Tax. Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. 370 Joint Filing Total.

Some accounts like a 401k FSA or HSA allow you to make pre-tax contributions.

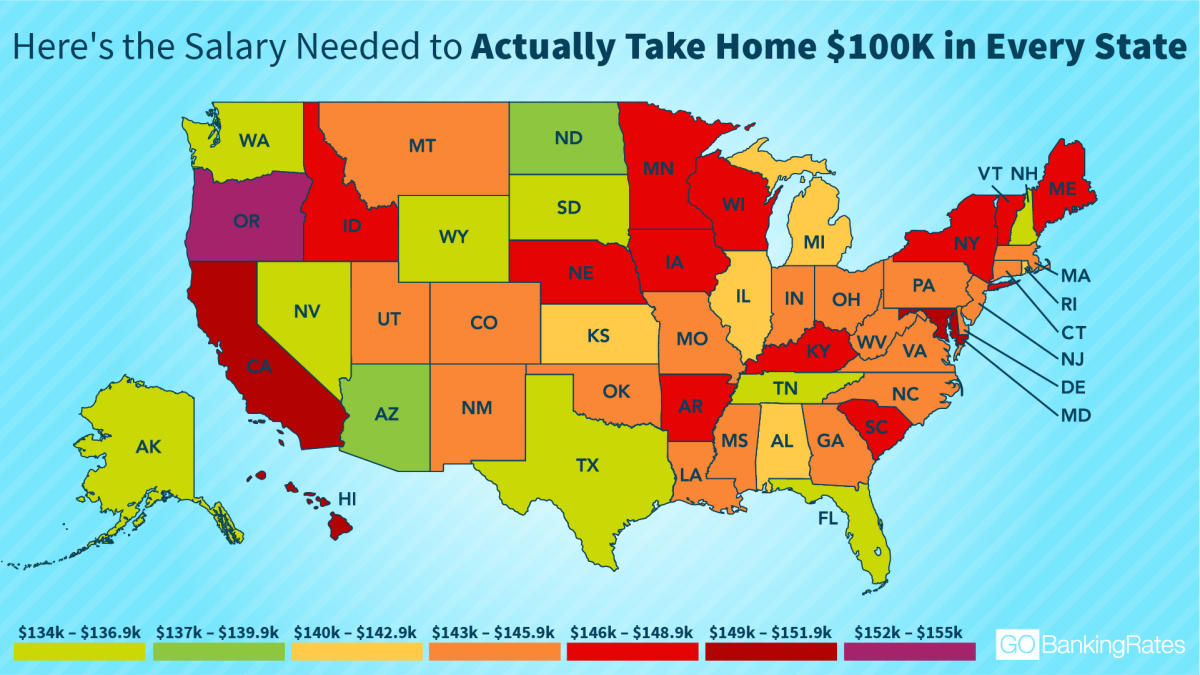

This Is The Ideal Salary You Need To Take Home 100k In Your State

Flat Bonus Pay Calculator Flat Tax Rates Onpay

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

5 Tricks For Getting A Bigger Paycheck In 2021 Money

Understanding Different Pay Stub Abbreviations

Here S How Much Money You Take Home From A 75 000 Salary

Illinois Estate Tax Everything You Need To Know Smartasset

Illinois Paycheck Calculator Adp

New Tax Law Take Home Pay Calculator For 75 000 Salary

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live

Understanding Your Teacher Paycheck We Are Teachers

Illinois Tax Rebates Eder Casella Co Certified Public Accountants

Vote Yes For Fairness This Is How Opponents Of The Fair Tax Think Of Hardworking Illinoisans Billionaires Like Liz Uihlein Don T Care About Our Middle And Lower Income Families They Only

Exemptions And Deductions Give Low Income Illinoisans Less Than Half Tax Rate Of Rich

2022 Federal State Payroll Tax Rates For Employers

New Tax Law Take Home Pay Calculator For 75 000 Salary

It S Tax Day Here Are 10 Things You Should Know About The Us Tax System